Every missed claim, delayed payment, or denied invoice quietly drains your practice’s revenue. You might not see it from day to day, but over the weeks and months, those little leaks do add up, sometimes into thousands of dollars. And the contrast between a practice that flounders in a cash-flow pinch and one that flourishes regularly boils down to how closely it keeps an eye on medical billing key performance indicators.

These are not your average key performance indicators on a report. These are real signals you can act on to learn how healthy your revenue cycle is. By tracking the right metrics, you can catch issues before they spiral, streamline collections, and make smarter financial decisions without adding time to your day.

If you’re serious about maintaining a smooth revenue cycle, these five KPI’s are not up for debate. They provide visibility into everything from claim accuracy to patient payments, and help make sure that every dollar your practice earns ultimately ends up in your bank account.

The 7 Essential Medical Billing KPIs

1. Days in Accounts Receivable (A/R)

Days in Accounts Receivable (A/R) is the first KPI in the list, and it tells you how many days it takes your practice to get paid after rendering care on average.

Why is this important? The longer the days in A/R, the longer you have cash tied up that you cannot use to pay for payroll, supplies, or purchase new equipment. Longer days in A/R are like cash stuck in molasses. Keeping an eye on this KPI will indicate to you when there is a delay and you can act before they become overdue, minimizing your risk of not getting paid.

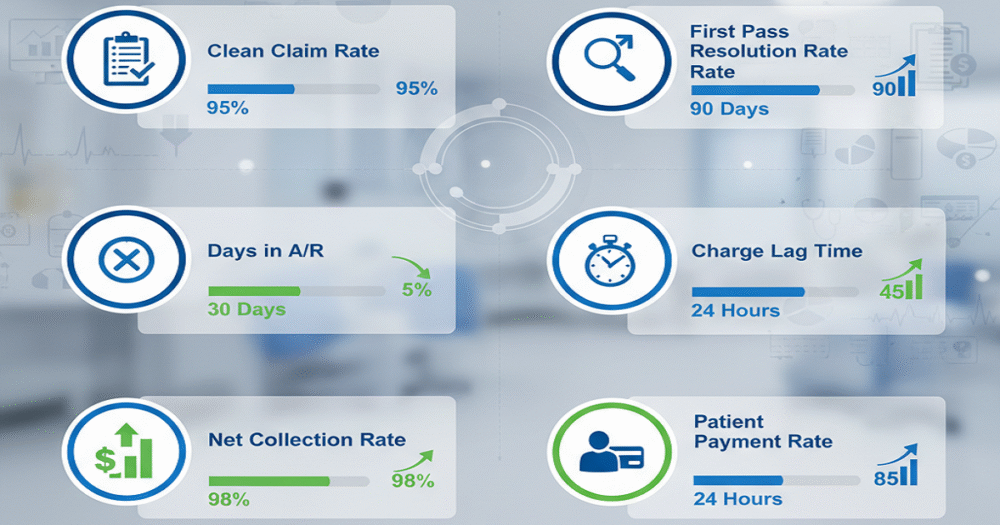

Improving A/R is easy to do: just continue to submit your claims on time, follow up on accounts that are past due on a regular basis, and focus your follow-up efforts on the older claims first. Any A/R that is at 30 days or less provides for a more efficient cash flow with fewer surprises in your bill-paying process.

2. Clean Claim Rate

The next indicator is the Clean Claim Rate, which shows the percentage of claims submitted for payment without errors. Errors can include incorrect patient data, coding errors or issues related to missing authorizations and/or precertifications, which can lead a claim to be rejected.

So, why should we care about this KPI? Each rejected claim takes longer to be paid and creates more work for office staff. By monitoring your Clean Claim Rate, you can identify your most common errors and try to correct them. Simple things can make a big difference: double-check the patient data, regularly update your coding, and consider having an automated check to catch mistakes prior to submission!

Finally, remember that high-performing outpatient practices usually average a Clean Claim Rate of above 95%, which allows for timely payment for visits.

3. Denial Rate

There may be denied claims even if submitted correctly. Denial Rate calculates the percentage of claims denied by payers, helping you identify trends that could be costing you money within your practice.

Denials are more than just inconvenient. They delay cash flow and increase workload. Tracking this KPI lets you spot recurring problems and implement solutions.

Start by analyzing denial reasons. Are they coding errors? Missing documentation? Coverage issues? Focus on the most frequent causes first. A low, sustained denial rate indicates that your claims process is effective, your billing team is doing its job, and cash flow remains stable.

4. Net Collection Rate

The Net Collection Rate shows how much revenue the practice has collected versus what was billed. It is a measure of how successful your practice is at converting charges into actual income.

A low net collection rate typically means you are losing money, which commonly comes from underpayments, claim denials, or uncollected patient balances. Tracking this KPI reveals ways you are missing opportunities so you can address them as needed.

Improving this metric may include ensuring insurance coverage beforehand, sending reminders on outstanding balances, or offering payment plans to patients for delinquent balances. Practices that pay attention to their net collection rate often experience more predictable cash flow at the end of each month with fewer surprises.

5. Patient Collection Rate

Even if you’re timely with insurance payments, slow patient payments can still leave considerable cash on the table. Tracking this metric is helpful in identifying areas for improvement and ensuring that patients are adequately informed of their financial responsibilities.

Some actionable steps you could take include clearly communicating payment expectations to patients, presenting multiple options for payment, and training your staff on advancing conversations about payment and payment expectations with confidence. When patients are aware of what they owe and how to pay for services, you will have improved payment collections, and the overall patient experience can be enhanced.

Practical tips include clear communication about payment expectations, multiple payment options, and staff training for handling payment conversations confidently. When patients understand what’s due and how to pay, collections improve, and so does the patient experience.

6. Charge Entry Accuracy

Charge entry accuracy monitors the proper coding and entry of services into the system, with errors in coding leading to delayed or denied claims and impacting almost every other KPI during the revenue cycle.

Why this is important: even minor inaccuracies in coding can potentially cause much larger issues with billing. A high charge entry accuracy prevents unnecessary denials of claims and reduces administrative burden as a whole.

Ways to improve: Ensure your billing staff are being trained on a regular basis related to coding updates, and encourage them to double-check their entries. Consider using a software tool to flag common mistakes, so those mistakes can be avoided or reduced, thereby reducing the billing costs.

7. First-Pass Resolution Rate

The First-Pass Resolution Rate is the share of claims that are approved on the first attempt to submit the claim. This is a key measure of overall billing efficiency.

Higher first-pass resolution rates indicate fewer cycles of rework, faster revenue, and reduced stress on your billing team. Lower first-pass resolution rates indicate inefficiencies, and perhaps even denial efficiency, that can affect your other key performance indicators (KPIs), for example, denial rate and net collections, which rely on accuracy in documentation.

Improving this KPI requires attention to detail in every step: accuracy in charge entry; accuracy and thoroughness in documentation; and proactively checking with payers. Over time, you will find that first-pass approvals contribute to a more seamless and predictable revenue cycle.

The Takeaway

Just about every healthcare practice has trouble keeping their revenue cycle strong. Tracking these seven KPIs for medical billing allows you not to worry about guessing where your money is going. After all, you will have meaningful insights that are actionable and can utilize in your decision-making, denial management, collections, and ultimately practice profitability.

Start small – pick a KPI or two, track it consistently, and then expand to more. Before long, you will see improvements in the revenue cycle – not just in revenue, but also in workflow, staff, and your own peace of mind.

A healthy revenue cycle doesn’t happen by accident. It happens when you measure what is important, take action on what you learn, and maintain the daily pulse on incoming and outgoing dollars. Start tracking these seven KPIs, and you will have control over the financial future of your practice.