Billing conversations often get tense the moment deductibles come up. Patients hear the word all the time, but many still don’t understand how it affects their visit. When that gap isn’t addressed early, the confusion shows up later in unpaid balances, callbacks, and a frustrated staff trying to explain charges after the fact. A simple explanation helps everyone, especially during busy months when deductible resets hit all at once.

What is a Deductible in Medical Insurance?

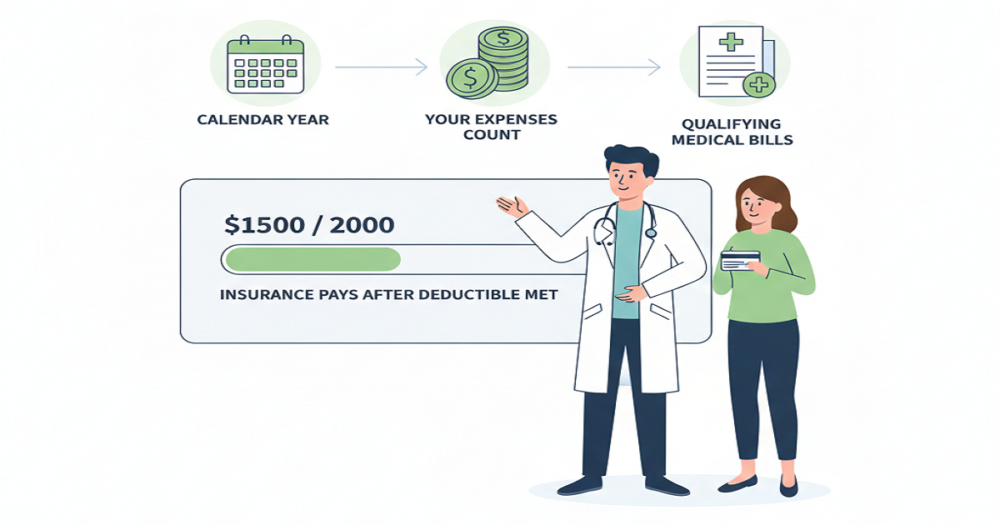

A deductible is the amount a patient must pay out-of-pocket before their insurance starts covering most services. Nothing complicated about the definition, but the way it plays out inside a practice has a real impact. The deductible determines how much the patient owes at the visit, how quickly payments come in, and how your team handles claims.

With deductibles trending higher each year, more of the financial load shifts to patients. That shift changes how providers need to approach payment discussions. It’s not enough for patients to know they “have a deductible.” They need to understand what that means today, for this visit, under their plan.

How Deductibles Actually Work

Breaking it down step by step usually clears things up for patients.

1. The patient pays the full allowed amount until the deductible is met

Take a plan with a $1,500 deductible. Until that amount is reached, the patient pays for covered services in full. This is where most misunderstandings happen. Many patients assume insurance covers part of the visit immediately. Your staff ends up re-explaining this more often than any other billing detail.

2. Once the deductible is met, cost-sharing begins

After the deductible is satisfied, the plan shifts to coinsurance. Maybe the plan covers 80%, and the patient covers 20%. The split depends on the policy, but the idea is the same: insurance helps more once the deductible requirement is out of the way.

3. A deductible isn’t the same as a copay

These two get mixed up constantly. A copay is a small fixed fee. A deductible is the larger yearly amount the patient must pay before real coverage starts. Keeping the explanation short works better than using insurance terminology.

4. Preventive care doesn’t always fall under the deductible

Under the ACA, a lot of preventive services are covered immediately. Patients sometimes expect every visit to count toward the deductible, so they get confused when certain services cost nothing. A quick heads-up from the staff avoids surprise later.

5. Deductibles reset every plan year

Some plans reset in January. Others reset based on when the coverage started. Because there’s no universal date, guessing leads to mistakes. Eligibility checks matter here, especially early in the year when billing issues spike.

2025 Deductible Trends Providers Are Dealing With

Deductibles continue to rise, and that changes patient behavior. For 2025:

- The average individual deductible is around $1,787.

- Out-of-pocket maximums sit near $9,450.

- HDHPs remain popular because monthly premiums keep climbing.

- Many patients pair HDHPs with HSAs to manage costs.

Rising deductibles mean more conversations about money before treatment. Practices that avoid those talks end up with delayed payments and higher collection efforts.

Family Deductibles and Their Impact on Billing

Family plans add extra layers that your staff must untangle.

Aggregate deductible

The family shares one deductible. As soon as the total is met, coverage applies to everyone.

Embedded deductible

Each family member has their own deductible inside the family plan. One child might meet their long before the others reach the combined amount.

These details matter when explaining charges. A lot of patient frustration comes from not understanding which version their plan uses.

Why Deductibles Affect Your Revenue Cycle More Than Ever

Deductibles aren’t just a patient concern. They change how your practice gets paid. High deductibles tend to lead to:

- larger balances owed by patients,

- slower payments,

- more follow-up calls,

- and more write-offs when patients can’t or don’t pay.

Premiums keep rising, and patients feel the pressure. When they’re surprised by their balance, they pause on paying it. That pause affects your cash flow. Having better explanations and clearer expectations helps avoid this.

Eligibility Checks: Your Best Friend During High-Deductible Season

Running eligibility checks before visits saves hours of cleanup later. These checks tell your team:

- the patient’s deductible amount,

- how much has been met,

- coinsurance rules,

- copay requirements,

- whether the service applies to the deductible,

- remaining out-of-pocket max.

With this information, the staff can give patients a realistic idea of what to expect financially. This helps reduce complaints and makes collections smoother. Urgent care centers feel the impact even more since those visits tend to happen early and often, making deductibles run out sooner.

Helping Patients Understand Their Costs Without Overcomplicating It

Patients don’t want a long insurance lecture. Clear, simple language works best. Something like:

“You haven’t met your deductible yet, so today’s cost applies toward it. Once you meet that amount, your insurance will start covering more.”

That one line prevents most of the back-and-forth later. Short explanations feel more honest and less overwhelming to patients. Sharing estimates helps too. Even a rough range gives patients time to prepare. When deductibles are high, offering payment plans keeps patients from delaying care and keeps your revenue steady.

Putting It All Together

Deductibles shape a huge part of the financial side of healthcare. They influence how patients make decisions, how quickly payments come in, and how complicated your billing cycle becomes. A staff that understands deductibles and can explain them without insurance jargon makes the entire process smoother.

With deductibles rising again in 2025, clear conversations, accurate eligibility checks, and realistic cost expectations matter more than ever. By taking these precautions, surprise balances are decreased, and patients feel better informed and supported during their appointments.