If you’ve ever opened your billing dashboard and seen a claim bounce back when you expected progress, you know how frustrating it is. The claim didn’t move forward, payment didn’t come in, and now the team has one more interruption to deal with. The tricky part is that not all unpaid claims mean the same thing. Sometimes it’s a rejection. Sometimes it’s a denial. And understanding the difference isn’t just helpful, it’s essential if you want a smoother billing workflow and fewer delays.

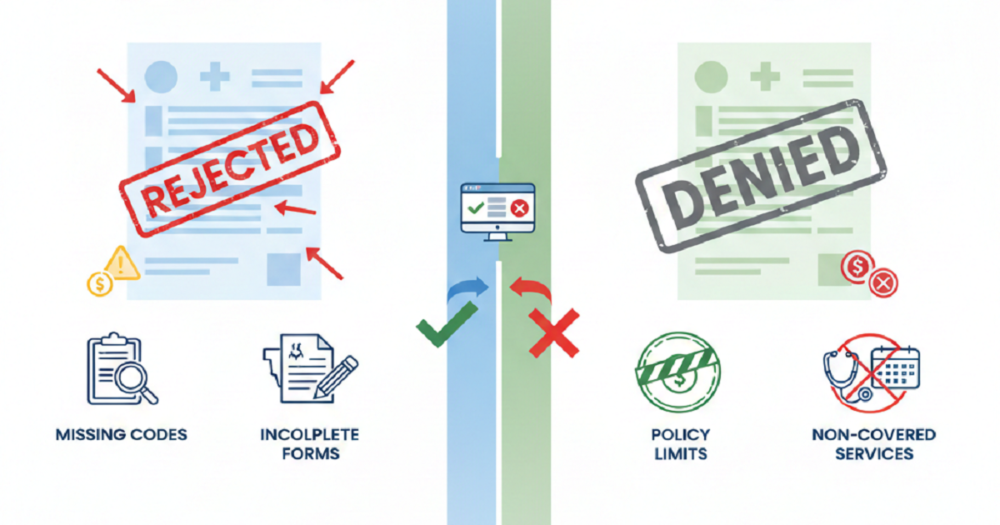

Many practices blur the two together, but that’s exactly where confusion starts. Claim Rejections and denials come from different causes, require different steps to fix, and impact your revenue cycle in completely different ways. When your team knows how to read them correctly, you save time, reduce rework, and protect cash flow.

Let’s make the difference easy to understand and look at how each one impacts your billing process.

What a Claim Rejection Really Means

A rejection happens before the payer even reviews the claim. Think of it as the claim never reaching the insurance company’s decision-makers. It gets blocked at the clearinghouse or payer intake system due to some aspect of the claim not adhering to their fundamental rules.

Usually, rejections happen due to:

- Wrong spelling of the patient’s name

- Wrong insurance ID numbers

- Procedure or diagnosis codes that are not accepted

- Differences in demographic information

- Fields that were supposed to be filled but are missing

These mistakes are small but disruptive. The good part? A rejected claim can be fixed quickly. Correct the issue, send it back, and the payer treats it like a brand-new claim.

What makes rejections risky is the filing deadline. If no one checks clearinghouse messages regularly, the claim may sit unnoticed until the submission window closes. And once that deadline passes, the chance to get paid is gone for good.

What a Claim Denial Actually Means

A denial is more serious. It means the claim did enter the payer’s system, was reviewed, and the payer made an official decision not to pay. This isn’t a formatting issue. It’s a coverage or documentation issue.

Denials often stem from the following matters:

- Mistaken or lost prior authorization

- Coding that is not consistent with the documents

- Medical necessity not clearly established

- Services not covered by the patient’s insurance plan

- Billing that has already been processed

- Verification problems

- Referrals that have expired

Rejections, on the other hand, can be quickly solved with a simple correction. However, denials may require a corrected claim, more documentation, or a formal appeal. Additionally, since each payer has different rules, the follow-up may take time.

Why Knowing the Difference Matters

When rejections and denials get mixed together, the workflow becomes chaotic. Rejections get treated like long-form problems. Denials get rushed through without enough review. And your clean claim rate drops fast.

Here’s the simplest way to remember it:

- Rejected claim = never processed.

- Denied claim = processed but unpaid.

Rejections are usually clerical mistakes. Denials point to deeper issues in documentation, coding, or authorization. Once your team knows which is which, you can assign tasks faster and reduce the chances of repeat errors.

How Rejections Affect Your Billing Process

Rejections interrupt the process at the very beginning. Even though the fix may be simple, the delay pushes everything back.

They affect your workflow by:

- Slowing down submissions

- Delaying payments across multiple claims

- Increasing manual data checks

- Creating more work at the front desk and billing end

- Putting timely filing limits at risk

The biggest problem is that rejected claims hide in plain sight. They don’t always show up in denial reports, so practices with small teams often miss them.

A strong daily habit is checking the clearinghouse dashboards every morning. It takes minutes but saves hours of rework later.

How Denials Affect Your Billing Process

Denials create a heavier workload. They require investigation, back-and-forth communication, and proper documentation. They also reveal where workflows need improvement.

Denials impact your billing process by:

- Slowing down reimbursement cycles

- Adding administrative tasks

- Increasing appeal volume

- Forcing coders and providers to revisit documentation

- Creating inconsistency in the monthly revenue flow

A pattern of denials usually points to something specific, like missing authorizations, a lack of documentation detail, or incorrect coding for certain services. The goal isn’t just to fix the denied claim but to identify why it happened so you don’t repeat it next month.

How to Reduce Claim Rejections

Even though rejections are annoying, they’re the easiest revenue leak to plug. Simple front-end improvements can prevent most of them.

These steps help:

- Verify insurance every visit, not just at first intake

- Confirm spelling, date of birth, and policy numbers

- Check eligibility in real time

- Use EHR tools to validate codes before submission

- Train front desk teams to catch common errors

- Run a quick pre-submission review

Rejections usually come from the basics. Tightening the basics improves everything else.

How to Reduce Claim Denials

Denials need a stronger strategy. They often tie back to payer rules, coding accuracy, and documentation clarity.

These steps make a big difference:

- Before the procedure, prior authorization should be secured

- Medical necessity should be documented in very clear and uniform manner

- Diagnosis codes should be aligned with the services rendered

- Get necessary updates on the payers’ policies

- Denial reports on a monthly basis can be used to recognize patterns

- Get a mutual understanding between the clinicians and the coders about the expectations

If your team understands why denials happen, prevention becomes easier, and turnaround time becomes shorter.

A Quick Way to Tell What You’re Dealing With

Here’s a simple test:

- If the payer never reviewed the claim, it’s a rejection.

- If the payer reviewed and refused the claim, it’s a denial.

- Clearinghouse messages = rejections.

- Explanation of Benefits (EOB) or remittance advice = denials.

Knowing the difference saves you valuable time and keeps the billing cycle moving without unnecessary stress.

Final Thoughts

When you understand claim rejection vs denial, your entire billing process becomes more predictable. Rejections interrupt the start of the process, but they’re usually simple to correct. Denials take longer to fix and often signal a need for stronger documentation, clearer coding, or better authorization checks.

Doctors and billing teams don’t have the time to chase the same issues week after week. When you catch rejections early and address denials strategically, your clean claim rate improves, payments arrive faster, and your practice maintains steady revenue without constant follow-ups.

If your team feels overwhelmed by claim issues or you’re struggling to stay ahead of rising denials, it may be the right moment to streamline your process or work with a billing partner who can handle the heavy lifting and help keep claims clean the first time around.