If you’ve worked in medical billing long enough, you can usually predict which claims will come back denied. There’s a feeling you get. Something looks slightly off. A diagnosis doesn’t fully support a procedure. A modifier might be missing. The insurance verification wasn’t rechecked. You submit it anyway because volumes are high and deadlines are tight. Two weeks later, it returns unpaid.

That cycle is exhausting. More importantly, it’s expensive.

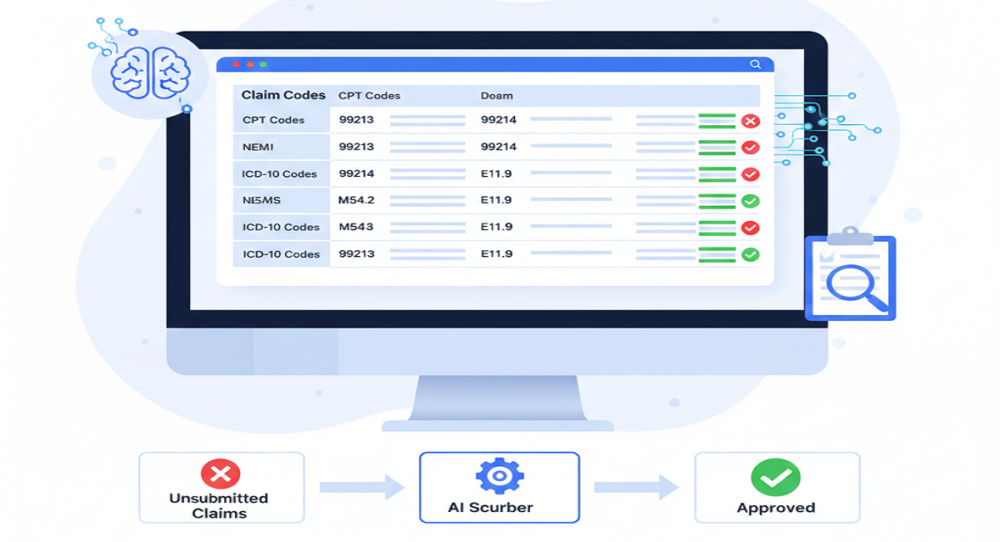

AI claim scrubbing exists to stop that cycle before it starts. Instead of fixing denials after payers reject them, it reviews claims in real time and prevents the mistakes that trigger those denials in the first place. That shift from correction to prevention is why denial rates are finally dropping in organizations that use it properly.

Let’s unpack how it actually works and why it’s becoming essential in 2026.

Why Denials Keep Increasing

Denials are no longer occasional disruptions. For many US providers, 11 to 22 percent of claims are denied on first submission. That’s not a small operational hiccup. That’s a revenue bottleneck.

The reasons are rarely dramatic. Most denials stem from routine issues like the following:

- Incorrect patient demographics.

- Eligibility that changed quietly.

- CPT codes that don’t align perfectly with ICD-10 diagnoses.

- Documentation that doesn’t clearly support medical necessity.

- Missing modifiers.

Each mistake feels minor. But every denied claim costs money to fix. Industry estimates show reworking a single claim can cost between $25 and $118. Multiply that across thousands of claims a month, and the financial impact becomes serious.

Manual reviews help, but humans are limited by time and volume. When billing teams are in a rush, subtle errors occur. That’s where AI makes a difference.

What AI Claim Scrubbing Actually Does

Traditional scrubbing systems stick to fixed rules. They make sure all the required fields are filled in and call out the basic mistakes. But AI takes things up a notch.

AI claim scrubbing uses machine learning, natural language processing, and predictive analytics. It’s not just looking for missing info; it actually figures out if the whole claim makes sense. It checks everything against payer rules, coding guidelines, and past denial patterns. So it’s not just about filling in the blanks; it’s about catching problems before they turn into rejections.

As soon as a claim is created inside your EHR or practice management system, AI begins reviewing it. There’s no waiting for a batch process at the end of the day. The validation happens instantly.

It starts with the basics: patient info, coverage, and authorizations. If something doesn’t match what the payer has on file, the AI flags it right away.

Then it analyzes coding logic. Does the CPT code logically match the diagnosis? Is a required modifier missing? Is the level of service supported by documentation? This is where natural language processing plays a role. The system reads clinical notes and compares them to the billed services. If the documentation doesn’t clearly justify the procedure, it highlights the gap before submission.

This layer alone drives clean claim rates close to 98 to 99.9 percent for many organizations. But the most powerful feature comes next. AI evaluates risk.

Predicting Denials Before They Happen

Every payer has patterns. Certain codes trigger more scrutiny. Certain combinations often get questioned. AI studies those historical denial patterns.

When a claim looks a lot like ones that got denied before, the system tags it with a risk score. Say there’s a 70% chance it’ll get denied because of how things have gone in the past; the billing team sees that heads-up right before they send it off.

That visibility changes behavior. Instead of discovering issues weeks later, staff can correct them immediately.

Organizations using predictive AI scrubbing report reducing first-pass denials by 30 to 40 percent. That improvement alone reshapes cash flow.

Reducing Rework and Saving Time

Denials don’t just cost money. They consume staff hours. AI scrubbing systems don’t stop at flagging problems. They suggest specific corrections like:

- Add a modifier.

- Adjust a diagnosis code.

- Clarify documentation.

- Verify eligibility.

Because corrections are guided, rework time drops significantly. Many practices see 50 to 70 percent reductions in manual edits.

That translates into shorter accounts receivable cycles. On average, AI-supported billing teams reduce A/R days by 10 to 13 days. Payments arrive sooner. Forecasting improves. Financial planning becomes steadier.

Why 2026 Makes AI Even More Important

Payer policies continue to evolve. Regulatory scrutiny remains high. Documentation standards aren’t getting simpler.

Now, if you’re still using those old rule-based systems, you know the pain. You have to keep updating them manually. They just can’t keep up. AI is different, as it keeps learning. If payers change their tactics, the AI adapts. That’s a game-changer.

That adaptability matters. It keeps clean claim rates stable even as policies change.

Some systems are now integrating enhanced compliance tracking and secure validation frameworks to strengthen audit readiness. While technology continues advancing, the core purpose remains the same: prevent avoidable revenue loss.

AI and Human Expertise Work Better Together

A lot of people think AI just takes over billing teams. That’s not really true. The grunt work is performed by AI, such as sorting large stacks of data, pattern detection, and managing all the new rules. However, when complications arise, you still require human beings. They are the ones who make difficult decisions, negotiate with payers, and take care of the strange cases. There is an increase in accuracy when you combine the two.

Billing teams with AI on their side stop wasting hours on denials they could’ve prevented. They get to focus on work that actually matters. And honestly, that shift makes the job feel a lot more meaningful. Morale goes up because now the work feels thoughtful, not just a scramble to keep up.

The Bigger Picture

Preventing 25 to 40 percent of first-pass denials is not a small operational tweak. It’s a structural improvement in revenue cycle management.

When clean claim rates approach 99 percent, revenue becomes predictable. Cash flow stabilizes. Growth feels less risky. That’s why AI claim scrubbing is no longer viewed as optional technology. It’s becoming a baseline expectation for competitive medical billing operations.

For teams that want both sharp AI checks and real human experience, Rapid RCM Solutions brings both to the table. You get better accuracy without losing the human touch.

Honestly, in today’s billing world, it’s not about scrambling to fix denials. The real win is stopping them before they start.