Denials are part of revenue cycle operations. Every billing team deals with them. A claim is submitted, the payer reviews it, and sometimes it comes back unpaid. The team checks the reason, corrects the issue, and decides whether to appeal.

That process is known as denial management. It has been the standard approach for years.

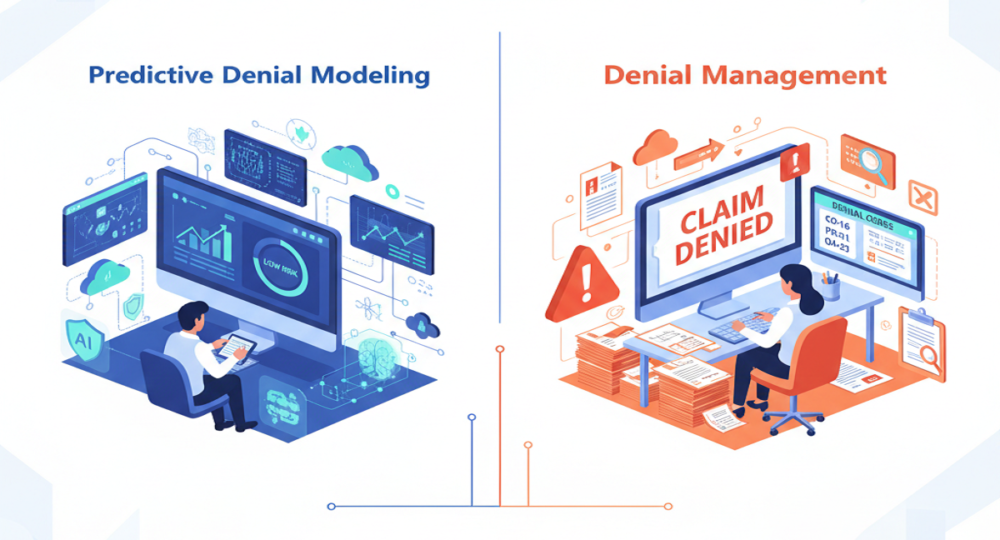

Lately, another strategy has gained attention: predictive denial modeling. Instead of responding to denials after they happen, this approach attempts to identify high-risk claims before submission.

Both methods aim to protect revenue. The difference lies in timing, workflow, and how data is used.

What Is Denial Management?

Denial management begins after a claim is rejected.

Once a denial is received, the billing team reviews the explanation of benefits or remittance advice. They identify the root cause, such as missing documentation, incorrect coding, or eligibility issues. If appropriate, they correct the claim and submit an appeal.

Strong denial management programs track denial trends. They categorize reasons, measure overturn rates, and prioritize higher-value cases. In many organizations, appeal success rates can reach 60% or more.

However, even successful appeals take time. Payment is delayed. Staff resources are used for research and follow-up. While recovery improves, the original disruption still occurred. Denial management improves response. It does not prevent the initial denial.

What Is Predictive Denial Modeling?

Predictive denial modeling is prevention-oriented.

It applies machine learning to historical claim data, payer behavior, coding patterns, and other variables. The system categorizes features that are linked with an increased risk of being rejected based on the previous denial trends.

When the new claim resembles such risk patterns, the system raises a red flag prior to the claim.

To illustrate, when a payer constantly rejects a particular procedure with a particular diagnosis, the model would identify such a combination. And then the billing team is able to review documentation or make edits to code and send the claim.

Organizations using predictive models often report denial reductions of around 29%. Clean claim rates can improve because risky submissions are corrected early. The main difference is simple. Predictive modeling works before the payer sees the claim.

Comparing the Two Approaches

The contrast becomes clearer when viewed side by side.

| Aspect | Predictive Denial Modeling | Denial Management |

| Timing | Pre-submission review | Post-denial review |

| Focus | Prevention | Recovery |

| Data Used | Historical trends + real-time claim data | Denied claim analysis |

| Impact | Fewer denials overall | Higher appeal success |

Both approaches rely on data. The difference is whether that data is used to anticipate risk or respond to outcomes.

How Data Is Applied Differently

Denial management relies on descriptive analysis. Teams examine denied claims and look for patterns in rejection reasons. Over time, they adjust workflows to reduce recurring issues.

Predictive denial modeling takes historical data and flips it, looking ahead instead of just tracking what’s already happened. Rather than sitting back and waiting for a pattern of denials to show up, the model digs through past results and uses those insights on today’s claims.

When it spots a claim that’s likely to get denied, it shows a flag for someone to take a closer look. Some of these models get pretty close to 95% accuracy when it comes to spotting risky claims. They don’t catch everything, but they do cut down on the denials that shouldn’t have happened in the first place.

Impact on Accounts Receivable

Denials slow down cash flow. The longer it takes to fix a denied claim, the longer you wait to get paid. No doubt, denial management helps you collect more in the end, but you’re still stuck with that initial delay.

Appeals eat up time, and payments from those don’t come in as fast as they do for clean claims. Predictive denial modeling steps in before things go off track. It helps keep more claims from getting denied in the first place, so you get paid faster, and days in accounts receivable drop.

Some organizations report denial write-off reductions of more than 40% after implementing predictive tools. This improvement results from submitting cleaner claims, not from appealing more aggressively. The financial difference comes from fewer interruptions in the payment process.

Practical Example

Think about a hospital dealing with constant denials for some outpatient procedures, and the problem always comes down to weak documentation. In the old way of handling things, the billing team would go through the denials, tweak their internal guidelines, and try to write better appeal documentation. Eventually, they’d see some improvement and get more decisions overturned.

With predictive denial modeling, the system detects that documentation gaps are consistently associated with those procedures. It flags new claims lacking specific language before submission. Providers adjust notes. Coders verify support. The claim is submitted with stronger documentation.

In the first scenario, recovery improves. In the second, the denial volume decreases.

Why Many Organizations Use Both

Predictive modeling does not replace denial management. Some denials happen because of mistakes or policy disagreements on the payer’s side, and you still need people to handle those. But when predictive tools cut down on avoidable denials, denial management teams get to spend their time on the tougher cases instead of fixing the same old problems. That mix leads to a smoother, more balanced workflow.

This combination creates a more balanced workflow.

Considerations for 2026

Payer rules keep changing, and they’re getting pickier about documentation and coding. If you’re always playing catch-up, you end up burning through resources fast.

Reactive workflows can become resource-intensive. Prevention helps stabilize workload and improve first-pass acceptance rates. For organizations evaluating revenue cycle performance, the question is not whether denial management is necessary. It is whether adding predictive prevention improves outcomes.

The answer depends on claim volume, denial patterns, and operational capacity.

Final Thoughts

Predictive denial modeling and denial management address the same issue from different points in the process.

Denial management steps in when claims get rejected and fights to recover the payment. Predictive modeling spots high-risk claims before anyone submits them, so there’s less chance of a denial in the first place. Put these two together, and you get cleaner claims and a smoother path to getting paid.

For healthcare organizations looking to strengthen both prevention and response strategies, Rapid RCM Solutions combines predictive review tools with experienced denial teams to support consistent first-pass performance.

In revenue cycle management, timing shapes results. Stopping denials before they happen takes a lot of the pressure off, way more than scrambling to fix things after the fact.