Revenue problems rarely start with big mistakes. More often, they begin with small misunderstandings that repeat quietly across hundreds of claims. One of the most common examples shows up during payment posting, when billing teams struggle to interpret insurance responses correctly. That confusion usually comes down to one question. What is the real difference between EOB vs ERA in medical billing, and why does it matter so much?

Understanding these two documents is not just a technical requirement. It directly affects cash flow, accuracy, and the speed at which accounts move from insurance to patient responsibility.

Understanding the Role of Payment Responses in Medical Billing

Every insurance payment follows a process. A claim goes out, the payer reviews it, and a response comes back explaining what happened. That response tells you whether the claim was paid, partially paid, denied, or adjusted. It also explains why.

This is where EOBs and ERAs come into play.

Both documents communicate payment decisions, but they do so in different ways and with different levels of efficiency. Treating them as the same creates gaps. Those gaps often turn into delayed follow-ups, missed underpayments, and incorrect patient balances.

What Is an EOB in Medical Billing?

An Explanation of Benefits, commonly known as an EOB, is a statement issued by an insurance payer after processing a claim. It breaks down the billed charges, allowed amounts, insurance payments, adjustments, and patient responsibility.

The key thing to remember is this: An EOB explains payment, but it does not move money.

Most EOBs arrive as paper documents or PDFs. Someone on the billing team must review them, interpret the reason codes, and manually post the information into the system. That process takes time and requires close attention to detail.

While EOBs provide valuable insight, they are slower and more prone to human error, especially in high-volume billing environments.

What Is an ERA in Medical Billing?

An Electronic Remittance Advice, or ERA, does the same what an EOB, just in a digital way that’s built for automation. ERAs transmit payment data electronically and integrate directly with billing or practice management software.

Instead of manual entry, payments and adjustments can post automatically when the system is properly set up. This reduces processing time and improves posting accuracy.

When you stack up EOBs against ERAs in medical billing, ERAs definitely make things move faster. But let’s be real, speed isn’t everything. Someone still needs to keep an eye on things to make sure everything’s accurate.

EOB vs ERA in Medical Billing: Key Differences That Matter

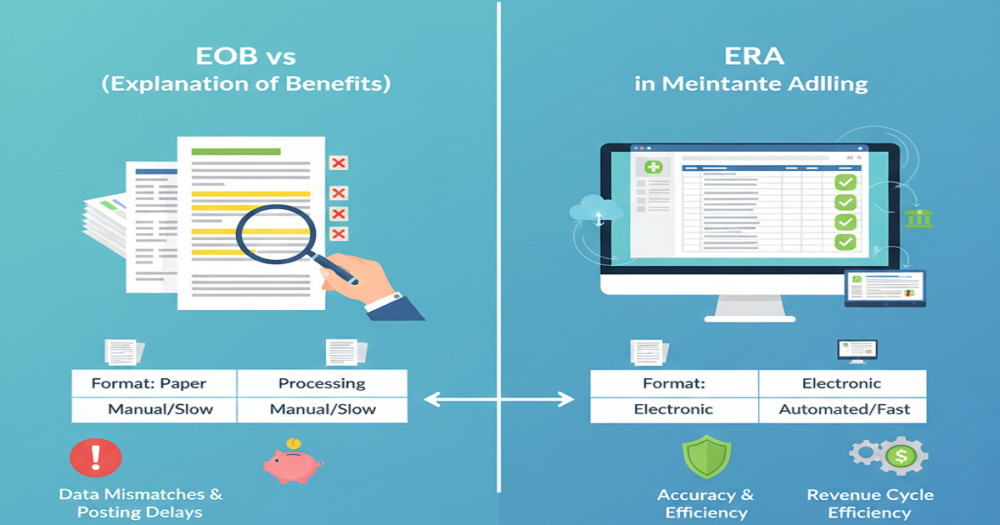

The most obvious difference lies in the format. EOBs usually show up on paper or as simple static files. ERAs, on the other hand, come in as structured electronic files.

Then there’s how you handle them. With EOBs, someone has to post everything by hand, which means more work and more chances for mistakes. ERAs let you set up auto-posting, so you save time as long as everything’s set up right.

Timing matters too. ERAs almost always get delivered faster than paper EOBs, so billing teams can match up payments and spot problems a lot sooner.

Finally, system dependency separates the two. ERAs require compatible software and proper setup. EOBs do not, but that simplicity comes at the cost of efficiency.

Why Confusing EOB and ERA Creates Billing Problems

Problems begin when teams assume automation replaces review. Auto-posting ERAs without checking for discrepancies can allow underpayments to slip through unnoticed. At the same time, manually posting ERA data defeats its purpose and increases posting delays.

Duplicate posting is another frequent issue. Payments get posted electronically through an ERA and then entered again when staff review the EOB. Balances inflate. Corrections follow. Time is wasted.

Patient billing also suffers. Incorrect patient responsibility amounts lead to delayed or inaccurate statements, which damage trust and slow collections.

This is why understanding EOB vs ERA in medical billing is operationally critical, not optional.

Common Errors Associated With EOBs and ERAs

A lot of people miss adjustment and remark codes, and that’s a big problem. Those codes tell you exactly why payments got cut or denied. If you skip over them, you’re basically throwing away your shot at an appeal.

Partial payments are another headache. Sometimes, you see a payment show up in the ERA, but the rest of the info only pops up later on the EOB. If you don’t keep track and match things up, accounts just hang there, unresolved.

Software doesn’t always make things easier, either. If the ERA codes aren’t mapped right, adjustments end up in the wrong place, and your financial reports go off the rails.

And let’s be real, people make mistakes. When people get tired, rush through posting, or don’t get the right training, those errors start to pile up fast.

Best Practices for Managing EOB and ERA Effectively

Efficiency improves when ERAs handle routine posting and EOBs support review. One should not replace the other.

Regular reconciliation should be part of the workflow. Compare ERA postings against EOB details to catch underpayments and denials early.

Training matters more than tools. Billing staff need to know how to read both documents, spot the usual codes, and figure out when it’s time to flag a problem. Don’t ignore your system settings, either.

When ERA mapping is dialed in, adjustments land where they should, and your reports stay solid. And don’t just set and forget, add review checkpoints along the way. Automation does its job best when someone’s actually keeping an eye on things.

How EOB and ERA Work Together in a Smart Billing Workflow

Instead of framing this as EOB vs ERA in medical billing, it helps to see them as complementary. The ERA delivers speed. The EOB provides an explanation.

Together, they form a complete picture of payer behavior and payment accuracy. ERAs move money quickly. EOBs explain exceptions clearly.

That combination supports faster resolution, cleaner accounts, and stronger revenue control.

Final Thoughts

Medical billing does not fail because of complexity alone. It fails when small details are misunderstood or ignored. Knowing the difference between EOB and ERA gives billing teams clarity, control, and confidence.

When automation is balanced with review, payment posting becomes predictable instead of reactive. Errors decrease. Follow-ups improve. Revenue stabilizes.

That clarity is not just helpful. It is essential.