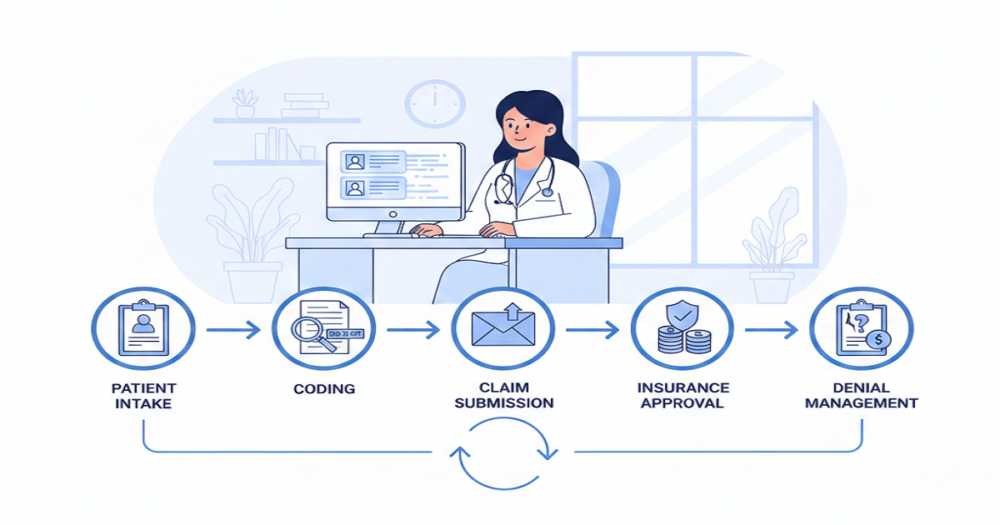

The financial side of a medical visit doesn’t end when the patient walks out. There’s a whole chain of tasks happening in the background, and each one affects how quickly a practice gets paid. When something in that chain slows down, the impact shows up fast, like delayed payments, confused patients, and a frustrated team trying to track down what went wrong.

Understanding what actually happens in the billing cycle helps keep everything moving instead of piling up.

Why Physicians Need a Working Picture of the Billing Flow

Every visit starts its own billing round. In many practices, money comes in roughly a month later if things go right. But that depends on early steps being done accurately. A missing authorization or unclear documentation can easily stretch the payment timeline far longer than anyone expects.

2025 brought a few updates, like real-time eligibility tools, adjusted E/M rules, and tighter payer oversight around quality measures. All of this means the billing cycle can’t be treated like background noise. It needs a bit of attention from everyone involved.

Step 1: Registration and Eligibility

It will always begin at the front desk. The crew collects the basic information, such as insurance cards, demographics, and the purpose of the visit. Minor errors in this area are usually a big problem in the future.

Eligibility checks identify problems prior to the commencement of the appointment. They indicate coverage status, the amount remaining that the patient owes on the deductible, and the requirement of a prior authorization. The omission of this step tends to result in refusals that would have been prevented.

High-deductible plans make early checks even more important because patients sometimes don’t realize how much of the bill they’re responsible for.

Step 2: Documentation and Coding

Physicians anchor this part. Their notes explain the story behind the visit, like what brought the patient in, what was found, and what was done. Coders read those notes and match them to ICD-10 and CPT codes.

If the note is unclear, coders can’t defend the claim. That leads to denials or payments that don’t match the service provided.

The 2025 E/M updates push for clearer, shorter documentation rather than long paragraphs that don’t add much. Many billing teams use tools that highlight missing pieces, but they still rely on accurate notes from the physician.

Step 3: Charge Entry and Claim Setup

After coding is done, charges get entered into the EHR or billing system. Each service from the visit needs to appear here. A single incorrect entry can cause insurer pushback later.

Once charges are in, the claim is built. Claim scrubbing tools look for missing modifiers, incompatible code pairs, or incomplete information. Fixing these errors now saves weeks of delays later.

Practices that take scrubbing seriously tend to get paid faster.

Step 4: Claim Submission

Electronic delivery of clean claims. Clearinghouses identify formatting errors and send claims to corresponding payers. Status updates on electronic submission also assist teams in tracking more effectively.

Payers then check the claim against their rules. If something doesn’t line up, like documentation too thin, wrong code pairing, expired coverage, then the claim stalls. Clean claims, on the other hand, move through quickly and usually get paid without back-and-forth.

Step 5: Posting Payments

When the payer finishes reviewing the claim, an ERA arrives. This lists what was paid, what adjustments were made under contract, and what portion now belongs to the patient.

Payment posting isn’t just data entry. It tells the practice if the insurer followed contract terms and helps catch underpayments. Correct posting also sets the stage for accurate statements later.

Step 6: Billing the Patient

In case the insurer does not meet the full amount, the patient is left with the balance. The definite ones are important. What patients desire is something they can discern, and not a block of codes that is not understandable.

Higher deductibles imply larger patient balances, and thus, it is worthwhile to provide payment plans or the online payment option to minimize friction. Smaller and more predictable statements tend to be paid sooner.

Step 7: Handling Denials

Denials still happen, no matter how careful the workflow is. When they do, the billing team looks at why the payer refused to process the claim.

Common reasons include:

- missing or incorrect modifiers

- unclear or incomplete notes

- coverage inactive at the time of service

- coding mismatches

- lacking prior authorization

Some tools help practices analyze denial trends so they can stop them at the source. Appeals happen when needed, using additional documentation or corrected codes.

A strong denial process recovers money that would otherwise just sit unresolved.

Step 8: Watching A/R and Cash Flow

A/R shows how well the billing process is working overall. If most claims are paid within 45 days, the cycle is healthy. If not, something earlier in the process needs attention.

High-deductible plans push more balance onto patients, which naturally slows payments unless the practice has a solid follow-up plan. Regular A/R reviews help teams catch aged balances before they become write-offs.

How the Steps Connect

It’s easy to look at these steps as separate tasks, but they’re tied tightly together. A small mistake in registration causes a denial weeks later. A vague note leads to a lower code and less reimbursement. A missing modifier stops the entire claim.

Physicians have more of the go than they think. Clear records, signature on time, and understanding of payer regulations bring down delays and enable the billing team to operate without unnecessary roadblocks.

A Billing Process That Actually Works

When the billing cycle runs the way it should, the entire practice feels the difference. Claims go out clean. Payments arrive on time. Patients understand their bills. Staff spend more time solving real issues instead of fixing preventable errors.

Insurance rules and reporting programs change often, but a solid billing workflow helps practices stay steady through those shifts. It supports both patient care and the financial side of the practice.