Why Insurance Claims Get Denied: The Hidden Billing Traps for Clinics

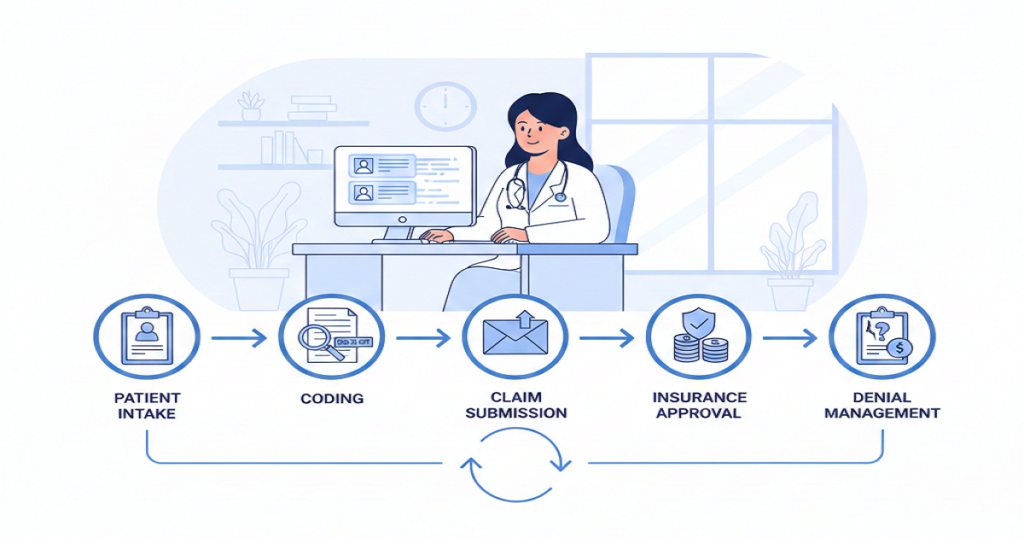

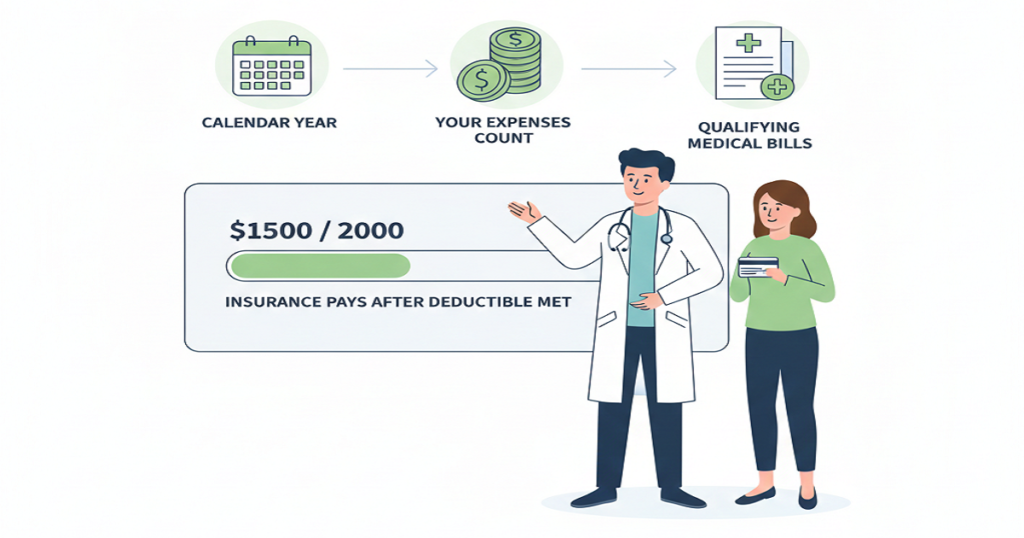

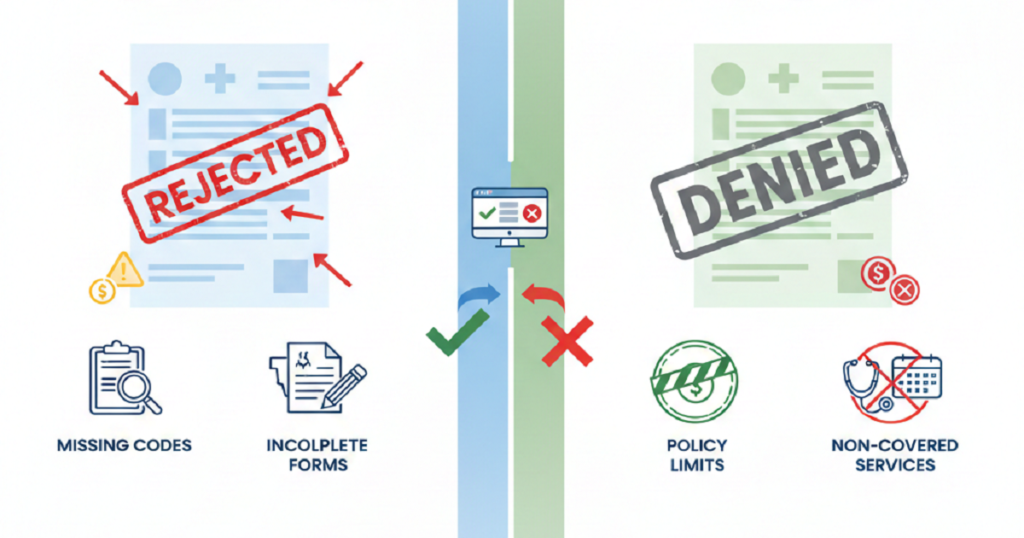

Medical BillingDo you know one of the biggest revenue leaks in medical practices doesn’t come from low patient volume, high rent, or even staff turnover? It arises out of insurance claims denials. All claims denied are revenue gained but never taken. This silent drain accumulates month after month, financial strain that seems difficult to overcome becomes a burden on many clinics. What is worse is that the majority of denials do not occur due to significant errors. They come from small, hidden billing traps that quietly slip into daily operations. Once you see these traps clearly, you can finally stop them from hurting your practice. How Claim Denials Quietly Disrupt Your Entire Practice Denials are not just accounting problems. They affect the entire clinic. When revenue slows, staffing decisions become harder, growth plans stall, and stress spreads across the team. Providers feel it, managers feel it, and patients feel it too. Yet many practices accept denials as normal when they should never be treated that way. Now let’s break down the traps. Common Billing Traps Clinics Fall Into Every Day Incomplete or Incorrect Patient Information Everything starts at the front desk. A missing digit in an insurance number, a wrong birthday, or an outdated plan can trigger an instant rejection. These details seem minor in a busy clinic, but insurance systems don’t allow for “close enough.” They require exact matches. When the information fails, payment stops, and your staff begins chasing corrections that could have been avoided. Skipping Consistent Eligibility Checks Many clinics verify insurance once and assume it stays valid. Unfortunately, coverage changes more often than people realize. Employers switch plans, deductibles reset, and benefits expire. When eligibility is not checked before every visit, claims go out with faulty assumptions. That mistake usually shows up weeks later in the form of a denial, followed by awkward patient conversations and extra billing work. Coding That Doesn’t Match the Chart Why Coding Breaks Claims Coding is one of the most fragile parts of billing. Guidelines change often, and insurers update their rules constantly. When a code does not fully match the provider’s documentation, payment stops. Even experienced coders face this challenge, especially when provider notes are rushed or unclear. How Insurers Catch It Insurance systems now compare codes to clinical notes in seconds. If the service, diagnosis, and documentation do not align perfectly, the claim fails. Weak Documentation Doctors focus on care, not paperwork. However, insurance companies only see the paperwork. If the notes do not clearly explain why a service was necessary, how it was performed, and what result it produced, insurers deny the claim. The care may have been excellent, but without strong documentation, payment disappears. Missing Filing Deadlines Every payer has strict time limits. Claims submitted late, even by one day, can be rejected with no chance of recovery. Staff shortages, system problems, and backlogs cause this more often than clinics expect. When the deadline passes, the revenue is usually gone for good. Prior Authorization Errors Some services require approval before treatment. When authorization is missing, expired, or incorrectly entered, insurers immediately deny. Fixing this after the visit is difficult and often impossible. This trap alone costs clinics huge amounts of lost revenue every year. Confusion with Multiple Insurance Plans Patients often carry more than one plan. If the wrong payer is billed first, the claim bounces. Each correction causes delays, more work, and rising frustration for both staff and patients. Charge Entry Problems Missed charges, duplicate records, or wrong units silently give rise to denials. These errors are magnified when there is a heavy load on billing teams. Each error increases processes and delays cash. Weak Denial Follow-Up Many clinics lack a strong denial management system. Some denials that could be overturned never are because appeals are late, incomplete, or not filed at all. Over time, these write-offs add up and quietly damage revenue. Outdated Technology Old billing systems and poor software connections allow errors to slip through. Modern insurers expect speed, accuracy, and compliance. Clinics using outdated workflows struggle to keep up, no matter how hard their teams work. How These Traps Affect the Whole Clinic The financial loss is only part of the damage. Staff become burned out. Patients grow confused and frustrated by billing problems. Providers feel constant pressure as income becomes unpredictable. Eventually, growth slows and stability weakens. How Clinics Can Start Fixing the Problem One small change is not the solution. It needs improved systems, regular processes, proper coding, excellent documentation, effective follow-up, and up-to-date tools. A combination of these pieces results in low denial rates and cash flow stabilization. Why the Right Billing Partner Matters All this becomes daunting to manage in-house. That is why most clinics resort to specialists who reside within payer regulations, coding changes, and denial patterns on a daily basis. An effective billing partner identifies issues prior to submitting claims, secures income, and ensures the cash flow is uninterrupted. Conclusion Claim denials are not random. They follow patterns created by hidden billing traps. Once those traps are exposed and fixed, everything changes. Revenue becomes predictable, staff stress falls, patient satisfaction improves, and your clinic finally regains financial control. If your practice is tired of chasing denials and losing hard-earned revenue, it may be time for real support. Rapid RCM Solutions helps clinics identify these hidden billing traps, correct the root causes, and build a clean, efficient revenue cycle that produces faster payments and long-term financial stability. When the right team stands behind your billing, your clinic can focus fully on what matters most: caring for patients and growing with confidence.

Why Insurance Claims Get Denied: The Hidden Billing Traps for Clinics Read More »